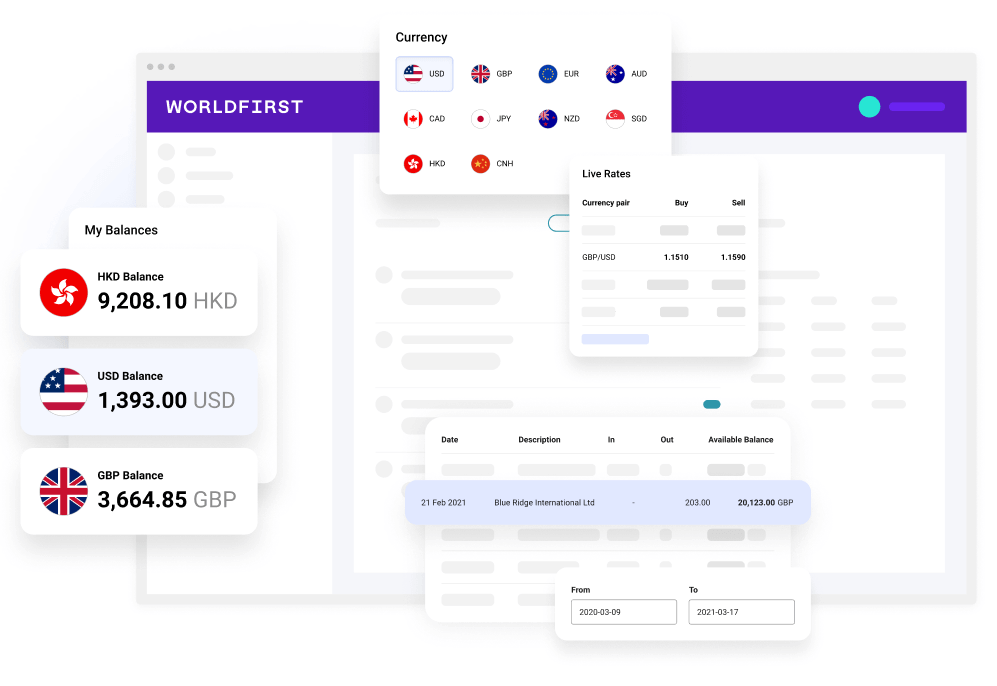

Why more than 250,000 global customers choose WorldFirst for their international transfers

Tailored foreign exchange solutions

Find out more about international money transfers with WorldFirst. We'll work with you to find tailored currency solutions that suit your specific needs: